working in nyc taxes

Transacting business in New York State and paying any wages subject to New York State personal income tax must deduct and withhold tax from those wages during each calendar year. If you are an employer as described in federal Publication 15 Circular E Employers Tax Guide and you maintain an office or transact.

Economic Nexus Adopted For Nyc Business Corporation Tax Pwc

Ad Leading Resource For Tax Practitioners.

. You should probably also have CT withhold. Census Bureau Number of cities that have local income taxes. Many people may not realize that you do not need to live in New York or be physically present there to be subject to New York income tax on your wage income.

New York Paycheck Quick Facts. Your Key New York Taxes Guidebook For 2022. New York income tax rate.

Print PDF Format. Ranges from 4-882 according to an employees income. Print eBook Format.

In Jersey City NJ the sales tax is only 33125. Print PDF Format. New York City has a separate city income tax that residents must pay in addition to the state income tax.

The tax rate youll pay. For instance the sales tax in New York City is currently 8875 while the sales tax rate in New. In New York the standard deduction for a single earner is 8000 16050 for joint filers.

Who must withhold personal income tax. The city income tax rates vary from year to year. Ad Leading Resource For Tax Practitioners.

A single person making the Long Island median household income of 112365 would pay about 6170 per year in state income taxes. If you are a salaried worker then you dont. Print eBook Format.

Your Key New York Taxes Guidebook For 2022. If you live on Long Island but. Additional commission or bonuses are withheld at a rate of 962.

New York Income Tax Rate. 25 days ago. Do You Need to Pay Taxes in Both NY and NJ.

This means that when calculating New York taxes you should first subtract that. Youll have to pay NYS taxes because the income is from NY and your employer isnt located in CT. The decision to live in New Jersey and work in New York might be cheaper on your taxes overall.

Notably sales tax in New York City is 8875 while in New Jersey the statewide retail sales tax is 6625. As a nonresident you only pay tax on New York source income which includes earnings from work performed in New York State and income from real property located in. Your New York employer pays for the commuter tax called the Metropolitan Commuter Transportation Mobility Tax MCTMT.

New York Payroll Taxes. The City Sales Tax rate is 45 NY State Sales and Use Tax is 4 and the Metropolitan Commuter Transportation District surcharge of 0375 for a total Sales and Use. Yes you will pay taxes in both states if you live in NJ and work in NYC but you wont be double-taxed as you will receive.

How Much Tax Is Deducted From A Paycheck In Ny Cilenti Cooper Overtime Lawyers In Ny

What Taxes Will I Pay If I Work In Manhattan And Live In Nj

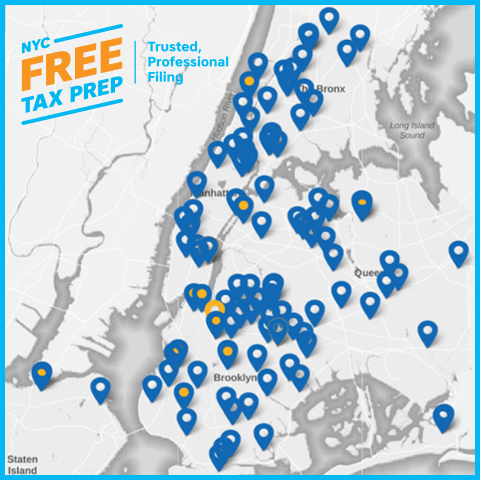

Dca Consumers Manage Money File Your Taxes

Is Tax Higher In New York Than In California Quora

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Nyc New York State Income Tax Rate Guide 2022 Propertyclub

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Dca Consumers Manage Money File Your Taxes

Nyc Property Tax Bills How To Find And Read Them Yoreevo

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

State Income Taxes Highest Lowest Where They Aren T Collected

The Tax Headaches Of Working Remotely The New York Times

Us Based Question If You Work In Your Firm S Nyc Fishbowl

Nyc Tax Saving Strategies A Helpful Checklist Tax Services Nyc

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

How Tax Brackets Work 2023 Tax Brackets White Coat Investor

Moving To Nj While My Office Is In Ny How Do Remo Fishbowl

New York Paycheck Calculator Smartasset

Solved Remove These Wages I Work In New York Ny And Live In New Jersey Nj